(Part 2) Top products from r/wallstreetbets

We found 36 product mentions on r/wallstreetbets. We ranked the 363 resulting products by number of redditors who mentioned them. Here are the products ranked 21-40. You can also go back to the previous section.

21. Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor

Sentiment score: 0

Number of reviews: 2

Show Reddit reviews

Show Reddit reviews22. The Intelligent Investor: The Definitive Book on Value Investing. A Book of Practical Counsel (Revised Edition)

Sentiment score: 2

Number of reviews: 2

This classic text is annotated to update Graham's timeless wisdom for today's market conditions...The greatest investment advisor of the twentieth century, Benjamin Graham, taught and inspired people worldwide.Graham's philosophy of "value investing" -- which shields investors from substantial error...

Show Reddit reviews

Show Reddit reviews23. Betrayal At House On The Hill

Sentiment score: 0

Number of reviews: 2

Tile by tile, terror by terror, build your own haunted mansion - and then try to escape it alive.With 50 blood-curdling scenarios, each trip to the house on the hill promises fresh horrors.Players must work together to survive the nightmare.Except for one player who becomes the traitor.3–6 players...

Show Reddit reviews

Show Reddit reviews24. The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management (Wiley Trading)

Sentiment score: 2

Number of reviews: 2

Wiley

Show Reddit reviews

Show Reddit reviews25. Ravenox Natural Twisted Cotton Rope | (Natural White)(1/4 Inch x 600 Feet) | Made in The USA | Strong Triple-Strand Rope for Sports, Décor, Pet Toys, Crafts, Macramé & Indoor Outdoor Use

Sentiment score: 2

Number of reviews: 2

✔ SUPER SOFT NATURAL COTTON ROPE DIRECT FROM THE MANUFACTURER: This all-purpose soft and strong rope is made in the USA by our team of rope masons at Ravenox Rope in North Carolina - we are 1 of only 29 American Cordage Institute approved manufacturer members in the world!✔ STRONG TRIPLE TWIST: ...

Show Reddit reviews

Show Reddit reviews26. The Options Playbook, Expanded 2nd Edition: Featuring 40 strategies for bulls, bears, rookies, all-stars and everyone in between.

Sentiment score: 1

Number of reviews: 2

Used Book in Good Condition

Show Reddit reviews

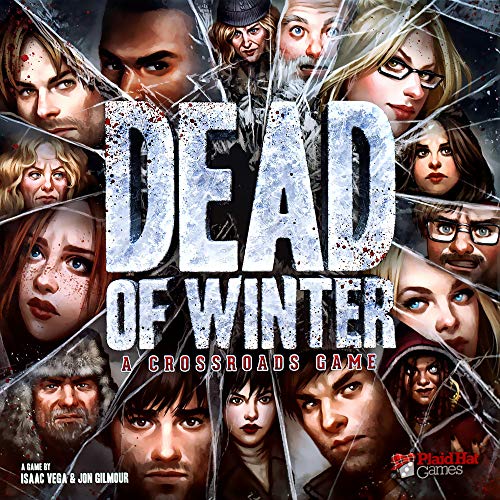

Show Reddit reviews27. Dead of Winter

Sentiment score: 0

Number of reviews: 2

For 2-5 Players90 minute playing timeGreat co-op gamePlayable in 100 minutesFor ages 12 plusFor two to five playersAges 13 and upPlayable in 100 minutes

Show Reddit reviews

Show Reddit reviews28. Natural Harvest: A Collection of Semen-Based Recipes

Sentiment score: 1

Number of reviews: 2

Used Book in Good Condition

Show Reddit reviews

Show Reddit reviews29. Dow 40,000: Strategies for Profiting from the Greatest Bull Market in History

Sentiment score: 1

Number of reviews: 2

Show Reddit reviews

Show Reddit reviews30. Titan: The Life of John D. Rockefeller, Sr.

Sentiment score: 0

Number of reviews: 2

(shelf 13.5.1)

Show Reddit reviews

Show Reddit reviews31. Everyone Poops (Turtleback Binding Edition)

Sentiment score: 0

Number of reviews: 2

Show Reddit reviews

Show Reddit reviews32. Security Analysis: Sixth Edition, Foreword by Warren Buffett (Security Analysis Prior Editions)

Sentiment score: 3

Number of reviews: 2

McGraw-Hill

Show Reddit reviews

Show Reddit reviews33. Market Wizards: Interviews with Top Traders

Sentiment score: 1

Number of reviews: 2

Show Reddit reviews

Show Reddit reviews34. Koch 5170625 Diamond Braid Polypropylene Rope, 3/16 by 100 Feet, Assorted Colors

Sentiment score: 1

Number of reviews: 2

Inexpensive, general purpose ropePolypropylene rope has a low stretch and good knot retentionResistant to oils, rot, mildew and most chemicalsAssorted colors, size 3/16 by 100 feetThe safe work load limit for this item is 30 lbs.

Show Reddit reviews

Show Reddit reviews35. The Complete Guide to Option Pricing Formulas

Sentiment score: 0

Number of reviews: 1

Show Reddit reviews

Show Reddit reviews37. The Option Trader's Hedge Fund: A Business Framework for Trading Equity and Index Options

Sentiment score: -1

Number of reviews: 1

Used Book in Good Condition

Show Reddit reviews

Show Reddit reviews38. Options for the Beginner and Beyond: Unlock the Opportunities and Minimize the Risks (2nd Edition)

Sentiment score: 0

Number of reviews: 1

Show Reddit reviews

Show Reddit reviews

For a lot of my basic knowledge I browsed investopedia and clicked on anything blue I didn't understand and held legitimate conversations with peers both on and off of reddit.

For example, take this submission about CDOs

Just start reading. If you don't understand something that's highlighted, like "derivatives" or "defaults", click on it and read that page. This can help you understand a lot of the technical terms and see how they're all related to one another.

I don't read many investing books as much as I try to absorb things about economics itself. Understanding how an economy functions is essential to trading. A good youtube channel that talks about economics can be found here. The videos are dense in information, but the input the creator gives is very solid. Not all of what he says should be taken as fact, but really it's just an analysis by a fundamentally sound economist.

Netflix has a few documentaries that are captivating. One is called Betting on Zero

The series "Dirty Money" has some interesting content within as well.

The Big Short is a movie that has valuable content if you watch it while considering what we know in hindsight of the 2008 financial crisis.

The most important part of investing is understanding what stimulates an economy or drives one into a recession.

My father is a successful investment banker and the two books he's always recommended are:

The Intelligent Investor

The Millionaire Next Door

🤷🏼♂️ WTF do I know? I got the question in the post wrong.

I am guessing you mean this book? I've never read it, we used a different text in my Derivative Markets class.

​

The manual I am studying from doesn't have a ton on Box Spreads, but this is what it says:

Box Spread

>A box spread is a four-option strategy consisting of buying a bull spread and buying a bear spread, where one spread uses calls and the other uses otherwise identical puts.

A box spread is used to lend or borrow money. Regardless of the movement of the underlying asset, the payoff is fixed and known in advance and is equivalent to a zero-coupon bond.

When the bull spread is created using calls and the bear spread is created using puts, the resulting payoff is the payoff of a long risk-free zero-coupon bond. In this case, the investor is lending money.

|Position|S(T)≤K1|K1<S(T)≤K2|S(T)>K2|

|:-|:-|:-|:-|

|Long call (K1)|0|S(T)−K1|S(T)−K1|

|Short call (K2)|0|0|−[S(T)−K2]|

|Short put (K1)|−[K1−S(T)]|0|0|

|Long put (K2)|K2−S(T)|K2−S(T)|0|

|Total Payoff|K2−K1|K2−K1|K2−K1|

Below is the payoff diagram of a box spread.

Diagram

Coach's Remarks:

Notice a box spread consists of both calls and puts. Technically, it doesn't satisfy the definition of a spread. However, because a box spread is a combination of two spreads, it is commonly regarded as a spread.Also, notice the payoff diagram does not start at a flat line of 0 from the far left or the far right. Thus, this strategy cannot be created using all calls or all puts. Thus, if we assume the strategy is created using options only, the strategy must be created with a mix of calls and puts. Of course, this strategy can also be created using other assets, such as a risk-free zero-coupon bond.When the bull spread is created using puts and the bear spread is created using calls, the resulting payoff is the payoff of a short risk-free zero-coupon bond. In this case, the investor is borrowing money.

Two books that would be pretty good starting points (and a 3rd book for extra measure):

The first book you wanna pay special attention to Chapter 8 and Chapter 20, but read it ALL:

https://www.amazon.com/intelligent-investor-book-practical-counsel/dp/0060115912/ref=tmm_hrd_swatch_0?_encoding=UTF8&qid=1557126552&sr=1-7

This one is more detialed

https://www.amazon.com/Security-Analysis-Foreword-Buffett-Editions/dp/0071592539/ref=pd_rhf_eeolp_s_pd_crcd_0_4/143-0942938-6072313?_encoding=UTF8&pd_rd_i=0071592539&pd_rd_r=98601957-062a-4d2b-b4e5-10c14a0c824b&pd_rd_w=EmVty&pd_rd_wg=tAgWo&pf_rd_p=36c62ed8-9692-4b91-aa9a-c4b3b85cc759&pf_rd_r=XJ4NTWQMJ5KPRKTHCEZT&psc=1&refRID=XJ4NTWQMJ5KPRKTHCEZT

This third book isn't "reuired reading" but wouldn't be a bad idea to read---it teaches a healthy degree of cynicism about the things you read in financial reports and the things CEOs will tell you on TV---like CNBC etc

https://www.amazon.com/Fooling-People-Complete-Updated-Epilogue/dp/0470481544/ref=sr_1_2?keywords=david+einhorn&qid=1557126776&s=books&sr=1-2

GOOD LUCK!!!!!

> I found this for you so you can practice. They even come in some really happy, fun colors :)

>

>Fail better next time, kid.

Fucking Savage

"Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market", 1999

https://www.amazon.com/gp/aw/d/0812931459

"Dow 40,000: Strategies for Profiting from the Greatest Bull Market in History", 1999

https://www.amazon.com/Dow-40-000-Strategies-Profiting/dp/0071351280

"Dow 100,000: Fact or Fiction", 1999

https://www.amazon.com/Dow-100-000-Fact-Fiction/dp/0735201374

Realize that you always need to be learning and taking in new information. You will never "master" the market, nobody else has mastered it either, so take others' opinions with a grain of salt.

As much as people joke around here it can be a good way to spur new thought. If someone says the market will crash in 3 days? Why? Do you agree? If so, why? What data can you come up with to support that? (Etc, etc). Your goal should be to become knowledgeable enough to look at the economic landscape and come up with a personal opinion about what will happen next.

Once you have an informed hypothesis on what will occur then you make investments based on those convictions.

Web resources:

http://markets.wsj.com/

http://www.bloomberg.com/markets/stocks/futures

https://www.tradingview.com/

http://seekingalpha.com/

WSB Cheatsheet = www.3xetf.com

> lost 3.4k

> should I kill myself WSB?

If you're asking this after losing only 3.4k, you probably should at least try. But since it seems like you can't get anything straight the first time around, I found this for you so you can practice. They even come in some really happy, fun colors :)

Fail better next time, kid.

Trading for a Living by Alexander Elder has been awesome so far.

Link: https://www.amazon.com/New-Trading-Living-Psychology-Discipline/dp/1118443926/ref=sr_1_3?keywords=trading+for+a+living&qid=1558507971&s=gateway&sr=8-3

Here's the next best thing.

https://www.amazon.com/Dow-40-000-Strategies-Profiting/dp/0071351280

I can recommend some reading for you to help you out.

How To Day Trade For A Living by Andrew Aziz☆☆☆☆☆

Trading For A Living by Alexander Elder

Day Trading 5-in-1 Bible by Samuel Rees

I am reading this book

So making sure I don't go tits up

Current position BA Puts $320 June 28 & SPY Puts for late June as well

>Plus Catan, Dead of Winter, Betrayal at House on the Hill is pretty dope

Get that normie trash outta here

https://www.amazon.com/Natural-Harvest-collection-semen-based-recipes/dp/1481227041

this will go perfect wiith it

This book will help you become prepared to rebuild your account in the event of a big draw down.

I started with this...

http://www.amazon.com/Understanding-Options-2E-Michael-Sincere/dp/0071817840/ref=sr_1_2?s=books&amp;ie=UTF8&amp;qid=1452437941&amp;sr=1-2&amp;keywords=options+for+beginners

Then after a year or two I moved on to this...

http://www.amazon.com/Option-Volatility-Pricing-Strategies-Techniques/dp/0071818774/ref=sr_1_1?s=books&amp;ie=UTF8&amp;qid=1452438013&amp;sr=1-1&amp;keywords=option+pricing+and+volatility

This is a good reference to keep by your side when thinking about strategies....

http://www.amazon.com/Options-Playbook-Expanded-2nd-strategies/dp/0615308147/ref=sr_1_1?s=books&amp;ie=UTF8&amp;qid=1452438066&amp;sr=1-1&amp;keywords=option+playbook

have fun faggot

https://www.amazon.com/Everyone-Turtleback-School-Library-Binding/dp/0613685725

This will help

Security Analysis https://smile.amazon.com/dp/0070132356/ref=cm_sw_r_cp_apa_i_6viwCb1DET9RK

If you like that shit read Titan and Carnegie as well. Throw in The First Tycoon and you got a comprehensive lesson in people who have more money than you will ever have.

I'm reading Margin of Safety right now, though it is extremely expensive. Was recommended to me by someone in another thread. It's about value investing.

The Options Playbook, Expanded 2nd... https://www.amazon.com/dp/0615308147?ref=yo_pop_ma_swf

It's worth the 20$

https://www.amazon.com/Market-Wizards-Interviews-Top-Traders-ebook/dp/B006X50OPW/ref=nodl_

https://www.amazon.com/Barking-Wrong-Tree-Surprising-Everything/dp/0062416049/ref=pd_lpo_sbs_14_t_0?_encoding=UTF8&amp;psc=1&amp;refRID=7VVXAWNB2M8WP1R84JKQ

and

https://www.amazon.com/Everybody-Lies-Internet-About-Really/dp/0062390856

https://www.amazon.com/gp/aw/d/B002T44UJW/ref=mh_s9_acsd_top_b292I_c_x_2_w?pf_rd_m=ATVPDKIKX0DER&amp;pf_rd_s=mobile-hybrid-3&amp;pf_rd_r=PSFC0B0BYXJ2C0FWYR6B&amp;pf_rd_t=30901&amp;pf_rd_p=a5d81c06-6104-5989-89f5-9487942c846b&amp;pf_rd_i=511394

This one: https://www.amazon.com/Titan-Life-John-Rockefeller-Sr/dp/1400077303

This one is a timeless classic and can't steer you wrong

A bit of a simplification, as you'd want to weight by probability for a specific price, but that just makes OP's outcome look even worse. Also, the outcome of earnings itself could have an affect on IV, so you'd probably want to consider historical earnings IV impacts as well.

I read this book: http://www.amazon.com/Options-Beginner-Beyond-Opportunities-Minimize/dp/0132655683?ie=UTF8&amp;psc=1&amp;redirect=true&amp;ref_=oh_aui_search_detailpage

Which left me with a feeling like I learned a bunch but it also felt academic which is why I wanted to try to go for this as a way to really cut my teeth. Do you have any book recommendations?

Duh. You have a bunch of fucking nerds in Wall Street now, this isn't the 1980s.

Plus Catan, Dead of Winter, Betrayal at House on the Hill is pretty dope you should try it out faggot

I bought a couple of these when I was just starting out.

Nowadays I keep one or two around as paper weights and used the rest just to wipe my ass.

I haven't YOLO'd since a big negative day back in 2014. My first recommendation is learn how to place stops before you're down $20k in one day!

Option Basics:

http://www.investopedia.com/university/options/

The Option Trader's Hedge Fund

http://www.amazon.com/The-Option-Traders-Hedge-Fund/dp/0132823403

Any/All of Jeffrey Augen's books:

http://www.amazon.com/Jeffrey-Augen/e/B001IGNL1K